Craigmont uses the allowance method to account for uncollectible accounts – Craigmont’s adoption of the allowance method for uncollectible accounts is a strategic accounting practice that merits exploration. This method provides a comprehensive approach to tracking and estimating uncollectible accounts, enabling Craigmont to maintain accurate financial statements and make informed business decisions.

Craigmont’s implementation of the allowance method involves estimating the amount of uncollectible accounts based on historical data and industry trends. This estimate is recorded as an allowance account, which is subsequently used to adjust the reported value of accounts receivable and net income.

1. Introduction

Uncollectible accounts, also known as bad debts, are accounts receivable that are unlikely to be collected due to various factors such as customer bankruptcy or financial distress. It is crucial for companies to account for uncollectible accounts accurately to maintain the integrity of their financial statements and make informed decisions about their credit policies.

The allowance method is a widely used accounting technique for estimating and recording uncollectible accounts. It involves establishing an allowance account, which is a contra-asset account that reduces the reported value of accounts receivable.

2. Craigmont’s Use of the Allowance Method: Craigmont Uses The Allowance Method To Account For Uncollectible Accounts

Craigmont uses the allowance method to account for uncollectible accounts. The company estimates the amount of uncollectible accounts based on historical data, industry trends, and an analysis of its current customer base.

Craigmont records the estimated uncollectible accounts as a debit to Bad Debt Expense and a credit to Allowance for Uncollectible Accounts. This reduces the reported value of accounts receivable on the balance sheet and recognizes the expense on the income statement.

3. Impact on Financial Statements

The allowance method has a significant impact on Craigmont’s financial statements:

- Balance Sheet:The Allowance for Uncollectible Accounts reduces the reported value of accounts receivable, providing a more realistic representation of the company’s collectible assets.

- Income Statement:Bad Debt Expense is recognized on the income statement, reducing net income. This provides a more accurate picture of the company’s profitability.

4. Comparison to Other Methods

Craigmont chose the allowance method over other methods, such as the direct write-off method, due to its several advantages:

- Consistency:The allowance method provides a consistent and systematic approach to accounting for uncollectible accounts, allowing for better comparability over time.

- Timeliness:The allowance method recognizes uncollectible accounts before they actually become uncollectible, providing a more accurate representation of the company’s financial position.

- Matching Principle:The allowance method matches Bad Debt Expense with the related revenue, ensuring that expenses are recognized in the same period as the revenue they generate.

5. Considerations for Craigmont

When estimating uncollectible accounts using the allowance method, Craigmont should consider the following factors:

- Historical Data:Analyzing historical data on uncollectible accounts can provide valuable insights into future trends.

- Industry Trends:Understanding industry-specific trends and economic conditions can help Craigmont make more accurate estimates.

- Customer Analysis:Assessing the creditworthiness of individual customers can help Craigmont refine its estimates.

6. Potential Improvements

Craigmont could consider the following improvements to its use of the allowance method:

- Aging Analysis:Implementing an aging analysis of accounts receivable can provide a more granular view of the collectibility of different customer accounts.

- Credit Scoring Models:Utilizing credit scoring models can enhance the accuracy of uncollectible account estimates.

- Automated Systems:Automating the allowance method process can improve efficiency and reduce the risk of errors.

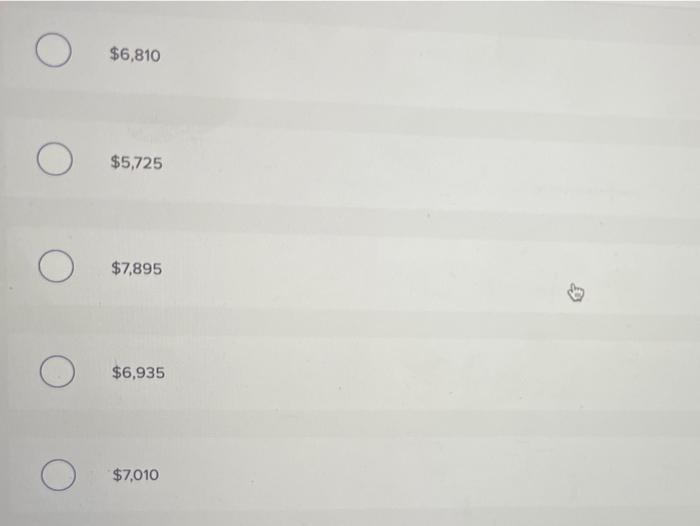

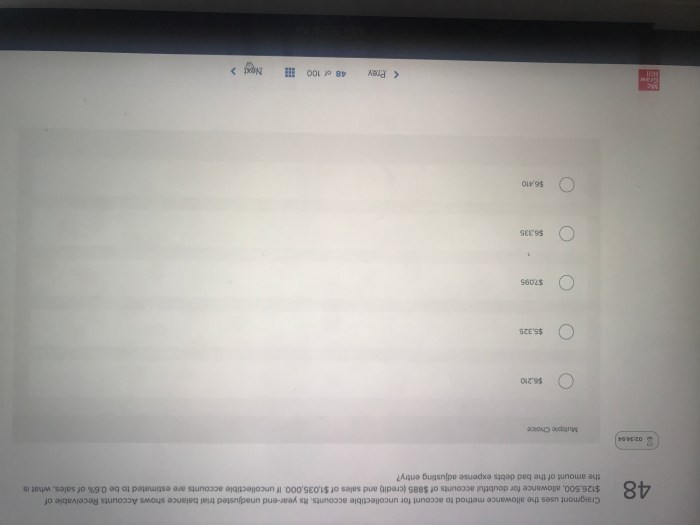

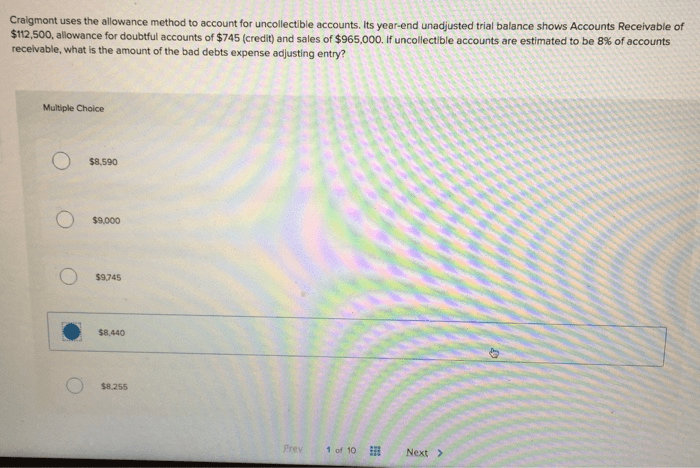

Answers to Common Questions

What are the benefits of using the allowance method for uncollectible accounts?

The allowance method provides a more accurate estimate of uncollectible accounts compared to the direct write-off method, resulting in a more accurate presentation of financial statements.

How does Craigmont estimate its uncollectible accounts?

Craigmont estimates its uncollectible accounts based on historical data and industry trends, using a percentage of its total accounts receivable.

What impact does the allowance method have on Craigmont’s financial statements?

The allowance method reduces the reported value of accounts receivable and net income, providing a more conservative view of the company’s financial position.